Ever more people are choosing to buy electric cars, also thanks to additional incentives for the purchase of new vehicles. It is now time for the industry to act and to establish battery factories rapidly in many parts of the world, including Europe. Known as gigafactories, they require huge levels of investment. But how and where can they become profitable businesses? A team of experts from Porsche Consulting has compared the associated opportunities and risks. Its comprehensive analysis focuses on modern battery technologies, efficient production processes, and the right sites and scaling for sustainable production in Europe.

EU countries are focusing on electromobility

Batteries play the same role in electric cars as engines do in conventional cars. They are of crucial importance for both the range and the charging speed. In the year 2021 they account for up to 40 percent of the overall cost of the new car. This makes electric mobility comparatively expensive. Their size, which is directly related to the range, is also an important factor in the decision to purchase an electric car. Nevertheless, the European Union (EU) saw a record number of newly registered electric cars in 2020, as reported by the European Automobile Manufacturers’ Association (ACEA). Premiums are still on offer to attract new customers because EU countries are placing a special emphasis on electric mobility in their efforts to meet the European Green Deal’s climate goals specified in late 2019.

“By 2030, Europe alone will need twenty Gigafactories to meet local needs.” Frank Seuster, Partner at Porsche Consulting, expert in the fields of product and technology

Electric cars generally have battery sizes of 50 to 100 kilowatt-hours. By 2030, battery production capacities will have to exceed 1,000 gigawatt-hours to meet the needs of European carmakers. The industry, therefore, faces the dual challenge of reducing its costs while building large-scale battery factories in Europe. These gigafactories will have to operate economically and sustainably. That is the only way to ensure sufficient availability of electric cars in every price class.

.png/jcr:content/MicrosoftTeams-image%20(2).png)

“Worldwide demand for traction batteries is likely to increase more than tenfold by 2030,” says Frank Seuster, Partner for Product and Technology at Porsche Consulting, in explaining the calculations by his team of experts. “By 2030, Europe alone will need twenty gigafactories to meet local needs.” Which battery technologies are produced, which production processes are used, and which site locations are chosen will be crucial factors for the business success of these companies and their investors. According to Seuster, more than 50 billion euros will need to be invested Europe-wide by 2030 for battery cell production alone.

Choosing the right battery technology

From the customer’s perspective, electric cars have to perform well compared to conventional car models with combustion engines. Many electric cars offer advantages in terms of acceleration and driving comfort. However, most customers are currently interested primarily in being able to drive long distances without breaks, i.e., in having to stop less often at charging stations. One solution is to have more powerful batteries with higher energy densities. A battery of the same dimensions would then have a greater range. Development work is therefore concentrating on increasing the energy but not the space. On top of that, batteries have to cost less. Both of these goals can be met with the help of technological advances.

Producers and suppliers are therefore devoting intensive efforts to improving extant lithium-ion technologies. Over the past two decades, they have managed to lower battery costs by around 80 percent. Step-by-step replacement of expensive cobalt with nickel has played a prominent role here. Both of these metals bind lithium in the layered structure of cathodes. The higher percentage of nickel has also helped to triple the energy density—which is responsible for the battery’s size and weight—within the same period of time. To further increase the range, a number of producers are studying how to enhance the chemistry of nickel-rich cells, with a special emphasis on safety and life span.

“For short-distance travel, lithium iron phosphate cells can accelerate the transition to electric mobility.” Lukas Mauler, Manager at Porsche Consulting, expert on battery technologies and the battery market

“Energy densities can be further improved by raising the percentage of silicon in the anode. Research is focusing on ensuring a sufficiently long service life,” says Lukas Mauler, Manager at Porsche Consulting and an expert in the field of battery technologies and the markets for these high-priority products. Mauler notes that depending on the vehicle segment, it can also make sense to use other chemical compositions of lithium-ion cells. “For short-distance travel, lithium iron phosphate cells can accelerate the transition to electric mobility because the cost benefits of this technology appeal to car buyers with a strong interest in price,” he suggests, adding that long service lives are also attractive for commercial vehicles and purposes.

Prospective Gigafactory builders should therefore choose the right future-oriented technology for the vehicle sector they expect to serve. Mauler notes it is essential for the product range to be flexible in order to address dynamic developments on the market. This also applies to the post-lithium-ion technologies of the future such as solid-state batteries. Production of this technology is expected to start within the next ten years.

Efficient and flexible production processes

The production spaces at Gigafactories—where electrodes are manufactured in multiple steps, mounted in cell form, and activated for later use—are undergoing dynamic development on a continuous basis. Considerable capital is needed to set up this type of factory: between two and four billion euros depending on anticipated annual production figures. According to the calculations in Porsche Consulting’s technology-based cost model, the highest single investments go to machinery and plants and account for around 10 percent of battery costs.

“Eliminating solvents that harm the environment means you can also eliminate the need for costly drying periods that require high levels of energy.” Dr. Fabian Duffner, Senior Manager at Porsche Consulting, expert in battery production and battery cost analysis

Operations at existing Gigafactories have been made more economical by speeding up processes and thereby lowering production costs. Additional effects are expected in the near future. New process technologies like dry-coating the electrodes promise further reductions in cost. “Eliminating solvents that harm the environment means you can also eliminate the need for costly drying periods that require high levels of energy,” says Dr. Fabian Duffner, Senior Manager at Porsche Consulting and the expert team’s specialist in production and costs. “This has a valuable double effect because you not only lower costs but also improve vehicle life-cycle assessments.”

.png/jcr:content/MicrosoftTeams-image%20(1).png)

All manufacturing processes can be made more efficient and sustainable by avoiding or minimizing rejects. That also applies to the defect rate in battery factories. The solution consists of early warning systems that prevent defects from arising in the first place. Smart factory strategies that digitally connect all the machines and plants can help by enabling reliable prognostics. If producers incorporate these types of enhanced processes in the initial planning stages for their Gigafactories and combine them with innovations, they can help achieve affordable and environmentally-friendly electric mobility, reduce investment costs, and remain competitive over the long term. Porsche Consulting advised LG Chem, a South Korean battery maker and leader on the global market, on setting up its battery factory in Poland. Kyong Deuk Jeong, President of LG Chem Wrocław Energy, reported that “with the maintenance approach of Porsche Consulting, we are able to increase our output by 14 percent.”

Advantages and disadvantages of individual sites

The cell factories of the future will be among the largest production buildings in the world. The respective companies favor different sites for their investments. Northvolt has picked Sweden, Volkswagen has chosen Germany, and LG Chem has opted for Poland. Proximity to the automotive production facilities scattered across the EU is not the only factor to play a role. Others include the availability of skilled workers, the anticipated costs for energy and personnel, and the availability of renewable “green” power.

The comprehensive site comparison by Porsche Consulting has shown that some EU countries do especially well in meeting two of these criteria but no single country currently leads in all three. Manufacturers, therefore, select their sites to fit their market positions and strategies. “Newcomers prefer countries with a sufficient pool of battery experts in order to catch up in terms of expertise, whereas established market leaders opt-in part for cost benefits in wages and energy,” says Dr. Fabian Duffner. Cell makers are also using renewable power for their Gigafactories as a way to stand out, which gives them a further competitive advantage. “In addition to zero-emission driving, customers and the public in general care about the resources consumed in their vehicle’s production process and batteries make up a large share of that,” explains Dr. Duffner.

Forecasting models help set the course

Can Gigafactories fulfill their crucial role in achieving climate-neutral mobility and thereby soon become giga-businesses? Outstanding opportunities do in fact await farsighted and strategically minded investors and manufacturers. “Dynamic developments in battery technology are generating enormous market potential on a trans-industry basis. Not only the automotive industry but also and especially the machinery and plant engineering sectors can benefit from entirely new possibilities,” says expert Lukas Mauler. In order to assess innovations on an overall basis, the Porsche consultants collaborate with a network of industry experts and researchers. Together the specialists use reliable forecasting models developed specifically for this purpose in order to evaluate market potential. “If the industry chooses the right course now in building battery factories, cars with electric drives will cost less than those with combustion engines by 2025,” predicts Mauler on the basis of his latest calculations.

How battery costs can be cut in half

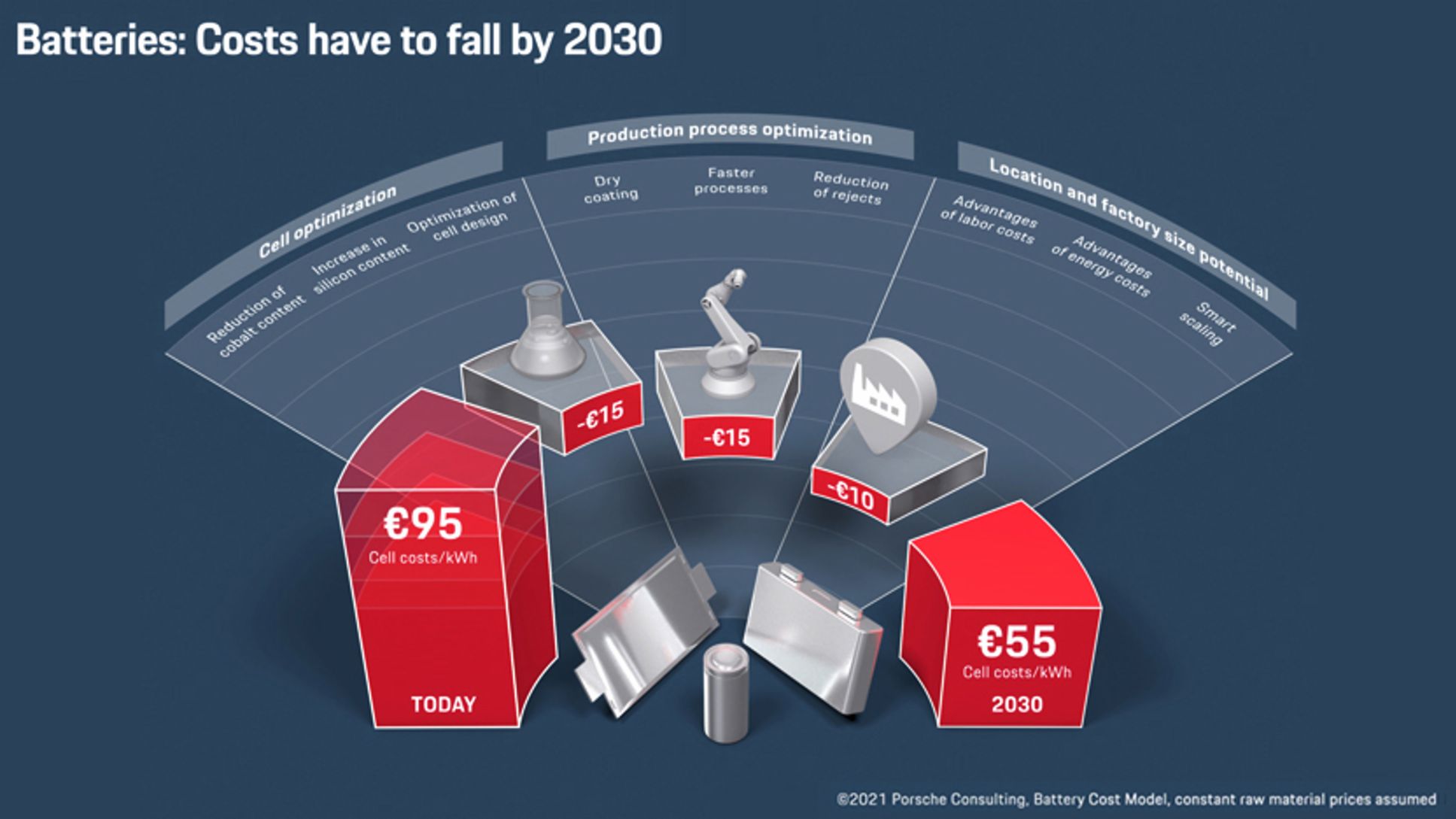

Porsche Consulting forecasts how innovations and market developments will influence battery costs. The company uses its own assessment models – which incorporate technical and commercial factors – to derive the level of future costs. If cell-level battery costs determined in a case study are currently at 95 euros per kilowatt-hour, by 2030 they can be cut to 55 euros by optimizing the cells and manufacturing processes and by selecting the right production site and size.

Cell costs can be optimized by reducing the amount of materials used. One promising strategy consists of progressively reducing the share of costly cobalt and replacing it with nickel and manganese. This gives the cells a more favorable chemical composition. Higher shares of silicon increase the cell energy content and thereby lead to more efficient use of other battery materials. In both cases, researchers are still working intensively on achieving sufficiently long battery service lives. Costs can also be lowered by improving cell and electrode design.

Innovations in production processes help to further reduce cell costs. New electrode dry-coating processes do not require environmentally harmful solvents, which also eliminates the need for the energy-intensive and expensive drying steps that account for a large part of the factory’s energy costs. To reduce costly rejects, smart factory approaches help to identify and eliminate their causes before they arise. Higher process speeds in numerous production steps also help to make better use of expensive machinery and plants.

In addition, battery costs can be lowered by utilizing site-specific advantages. Locations with low energy, personnel, and construction costs offer potential here. However, each company needs to weigh this potential against further criteria like a sustainable energy supply and the availability of skilled workers. As the demand for batteries rises, manufacturers gain more freedom to scale their factories in intelligent ways and to achieve economies of scale. Higher production capacities enable them to coordinate the manufacturing process in more favorable ways, which in turn allows more efficient employment of the requisite high investment costs.

10 important questions about batteries

1. Are there enough raw materials to produce the batteries for all electric cars?

In principle, the world has sufficient reserves of raw materials like lithium, nickel, and cobalt. One challenge lies in how soon supply chains can be set up to meet manufacturers’ and customers’ sustainability criteria. Car makers are signing long-term supply contracts with certified raw material companies. Direct investment in raw material mines is another strategic option to hedge both volume and price risks. A large share of future raw material needs will be met by processes that recover used materials and return them to circulation.

2. How can we reuse battery components?

Batteries contain large amounts of valuable reusable metals. The industry is trying to establish a closed-loop to reduce the amount of newly mined materials. Carmakers are working with raw material suppliers on pyro- and hydrometallurgical processes to enable economic recovery of high shares of the cobalt and nickel. In connection with the European Battery Alliance, the EU also proposed a new regulation in December 2020 with binding specifications for recycling batteries. As of 2026, 90 percent of the cobalt, nickel, and copper and 35 percent of the lithium have to be recovered from used traction batteries. As of 2030 these values will rise to 95 and 70 percent, respectively. The first pilot recycling plants in Europe have already started operating, such as the Volkswagen facility in the northern German city of Salzgitter. It will be processing around 3,600 car batteries a year, with higher volumes expected as of 2025 when the number of old batteries rises.

3. How often do electric cars need new batteries?

As a rule of thumb, a traction battery should still have at least 70 percent of its original capacity after 1,000 full cycles of charge and use. For conventional electric cars that should correspond to over 200,000 kilometers, which is roughly the service life of a combustion engine. Cars with especially stable lithium iron phosphate batteries can drive 500,000 or more kilometers. Leading car makers are currently guaranteeing 160,000 kilometers or offering battery leasing models.

4. What is meant by a battery’s “second life”?

There are a number of models by which batteries can be put to a second use. When batteries drop below 70 percent of their original capacity, comparatively healthy cells can be used in other vehicles as replacement parts. They can also start a second life in stationary applications for purposes such as stabilizing power grids or storing renewable energy temporarily for those days with little wind or sun. Batteries can therefore help achieve not only the mobility transition but also the energy transition.

5. What role does the battery play in an electric car’s life-cycle assessment?

Batteries are responsible for more than half the CO2 emissions in producing electric vehicles. A battery-powered car can only make up for this “greenhouse-gas debt” compared to conventional cars during its period of use. To do so, an electric car needs to drive 40,000 kilometers charged by renewable energy, according to a study by the ADAC (Germany's largest automobile association). If the battery was produced with green power, its debt is considerably smaller and can be made up sooner.

6. How long does it take to charge a battery?

Several factors play a role here, including the charging station’s output current and speed, the car’s level of technology, and the amount of charge left in the battery. If an HPC (high-power charging) station is available, a Porsche Taycan battery for example can be charged from 5 to 80 percent in less than half an hour. Equipment provided for home use enables cars to be charged overnight.

7. Where can batteries be charged?

In addition to charging at home and at low-power public stations, as of spring 2021 there are already around 3,500 public HPC (high-power charging) stations in Europe. This network will be rapidly expanded over the coming years. Volkswagen is working with Ionity and other partners to raise the number of European HPC stations to 18,000 by 2025.

8. Does Europe have sufficient technical expertise to produce batteries?

Asian manufacturers have led the way in industrialized mass battery production over recent decades and therefore have a head start in expertise. The industry in Europe is working on catching up. Nearly all European carmakers have launched battery development centers. Some, including Volkswagen AG and Groupe PSA in France, are planning their own battery cell production facilities. Europe’s strong machine and equipment sector is also helping to build expertise. The Bühler Group, for example, is a leader in the mixing technology for battery materials, and Manz AG offers turnkey solutions for battery cell production.

9. Which battery technology will come out ahead?

All the major manufacturers are currently relying on lithium-ion technology. Today, this technology is the one best able to meet customer demands. Further improvements are expected in the future from post-lithium-ion technologies. These include solid-state, lithium-air, and lithium-sulfur batteries, although all are presently still in the research stage. Industrial production of solid-state batteries for certain vehicle sectors is expected to get underway within the next ten years.

10. Where can batteries be used apart from cars?

Dynamic advances in battery technology are also making electrification more attractive in other sectors. In addition to cars and stationary energy storage, research is focusing on agriculture, construction, trains without overhead lines, shipping, and aviation. The technical and commercial demands placed on batteries differ greatly for different products. Battery use will therefore depend on how the technology progresses and will become useful at different points in time.

Info

Text first published in Porsche Consulting Magazine.